These have long been considered to generate solid returns and have historically been closed off to retail investors. Many of Golden Capitals’ investment opportunities are backed by collateral, which has the potential to afford you a degree of security for your capital.Īsset classes available on the Golden Capital platform include real estate, commercial finance and Cryptocurrency finance. Even better, you can get started with as little as $100 and grow your portfolio by reinvesting your earnings. One of the best things about investing with Golden Capitals is the ability it affords to access a broad range of asset classes that typically operate independently of the stock market. Golden Capitals is an alternative investment platform connecting mainstream investors with passive income-producing opportunities typically available only to institutions and the super-wealthy. Golden Capitals and Passive Income Generation Contributing to to your 410(k) plan at work and investing the money will generate passive income - and even more so when your employer offers matching funds and you start investing at a young age. However, that’s when you’re going to need a source of passive income the most. Investing for your retirement is an oft-overlooked form of generating passive income, probably because you’ll only see the return after you stop working.

So too will taking in a roommate or a boarder. Renting your driveway will generate passive income. Let’s say you own a home near a heavily used transit station, or in an area where monthly parking fees are high. What’s more, doing so can be more affordable than you might think. Purchasing a rental property is a tried and true method of setting yourself up to benefit from passive income generation. In fact, there are a number of simple ways to make money without physically working for it.

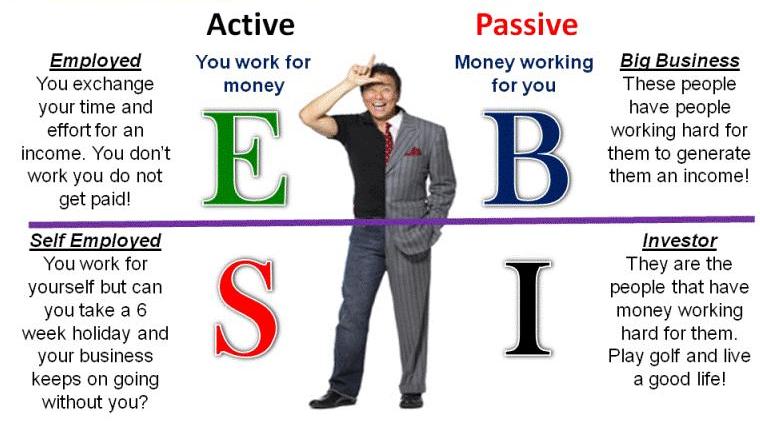

While it might seem a bit abstract at first glance, generating passive income is easier than it looks. According to Statista, the average tax rate on wage earners was 13.29% in 2019. The other downside is that active income typically comes with a rather significant tax liability. One is you can only generate an active income for as long as you are physically able to perform the task or provide the service for which you are paid. While its potential is virtually unlimited, an active income does have shortcomings. Lawyers, writers, photographers, business advisors and the like earn their incomes in the form of fees.

Independent professionals, consultants and freelancers are paid fees in exchange for completing a specific task or set of tasks. If you sell a home for $1,000,000 at a 3% commission, you’ll earn $30,000. For example, real estate agents earn a percentage (usually 3%) of the sale price of a home when they find a buyer for it. These are paid in the form of a percentage of the price for which you sell a good or service. One of the most lucrative forms of active income is commissions. However, wage earners can increase their incomes by working additional hours, which is also known as overtime. The most common form of active income is the money you’re guaranteed to receive annually in exchange for sharing your time and skills with an employer - your salary.Īlong these same lines is the hourly wage, which, unlike a salary, is only guaranteed for the number of hours you and your employer agree upon. What is Active Income? As mentioned above, active income is earnings derived from an effort of some sort.

0 kommentar(er)

0 kommentar(er)